Retail Recon: The Protein Bars Category

March 3, 2021

In the digital age, retail is war. Changes in the landscape have empowered startups and put incumbents at risk. Nowhere is this more true than in the world of eCommerce, where fortunes can be won or lost faster than ever before. In our new Retail Recon (tm) series, we’ll be sharing “news from the front,” category by category. We’ll show you who’s winning and share the eCommerce marketing and sales tactics that are driving their results.

We’ve chosen to kick off this series with a category that’s well established, highly competitive, and home to sophisticated brands: Protein Bars. Let’s have a look at who’s winning, why they’re winning, and what they could be doing better.

Protein Bars Category at a Glance

Like many American innovations, protein bars were born out of the space race. Pillsbury set out to create the ideal astronaut fuel—a product that could offer the same nutritional benefits as perishables like fruits, vegetables, and meats but could be stored for long periods without need for refrigeration. The resulting product, dubbed “Space Food Sticks,” was marketed in the early 1970s as a balanced nutritional snack. Later, in the 1980s, other brands began manufacturing and marketing protein bars to athletes. Soon after, they made their way into popular food culture.

Today, protein bars have an estimated annual revenue of almost $200 million on Amazon, where the term “protein bars” gets over two million searches per year. Shoppers are brand-driven, often searching for their favorite protein bar by brand name. Branded keywords like “cliff,” “quest,” and “rx” each get hundreds of thousands of searches per month.

As both a health supplement and a food item, these products qualify to be listed in two different Amazon departments: Health, Household & Baby Care and Grocery & Gourmet Food. Walmart.com has a similar setup with Protein Bars appearing both in the Food and Health departments. Although the type of bar present in each department differs significantly, both are overrun with competition. If you’re looking to sell your new protein bar on either of these retailers, you’ll need to differentiate your brand, find your niche, and kick-off with strong marketing chops. Below, we’ve taken a closer look at the eCommerce strategy behind two of the top players in this category: RXBAR and Oatmega.

RXBAR

With an estimated annual Amazon revenue of about $25 million, RXBAR is a true champion. When you consider the fact that they’ve only been around since 2013, this number is even more impressive. The brand has done so well, in fact, that it was purchased by the Kellogg Company for $600 million. But how did it make so much headway on Amazon so quickly? The answer lies in product design, application of ecommerce content best practices, and marketing execution.

Success Drivers:

-

Product descriptions on all listing pages are benefit-driven and keyword-rich. Although a lot of information is present, it all reinforces the brand’s main mantra of simple ingredients. Every bit of the listing points back to this differentiator.

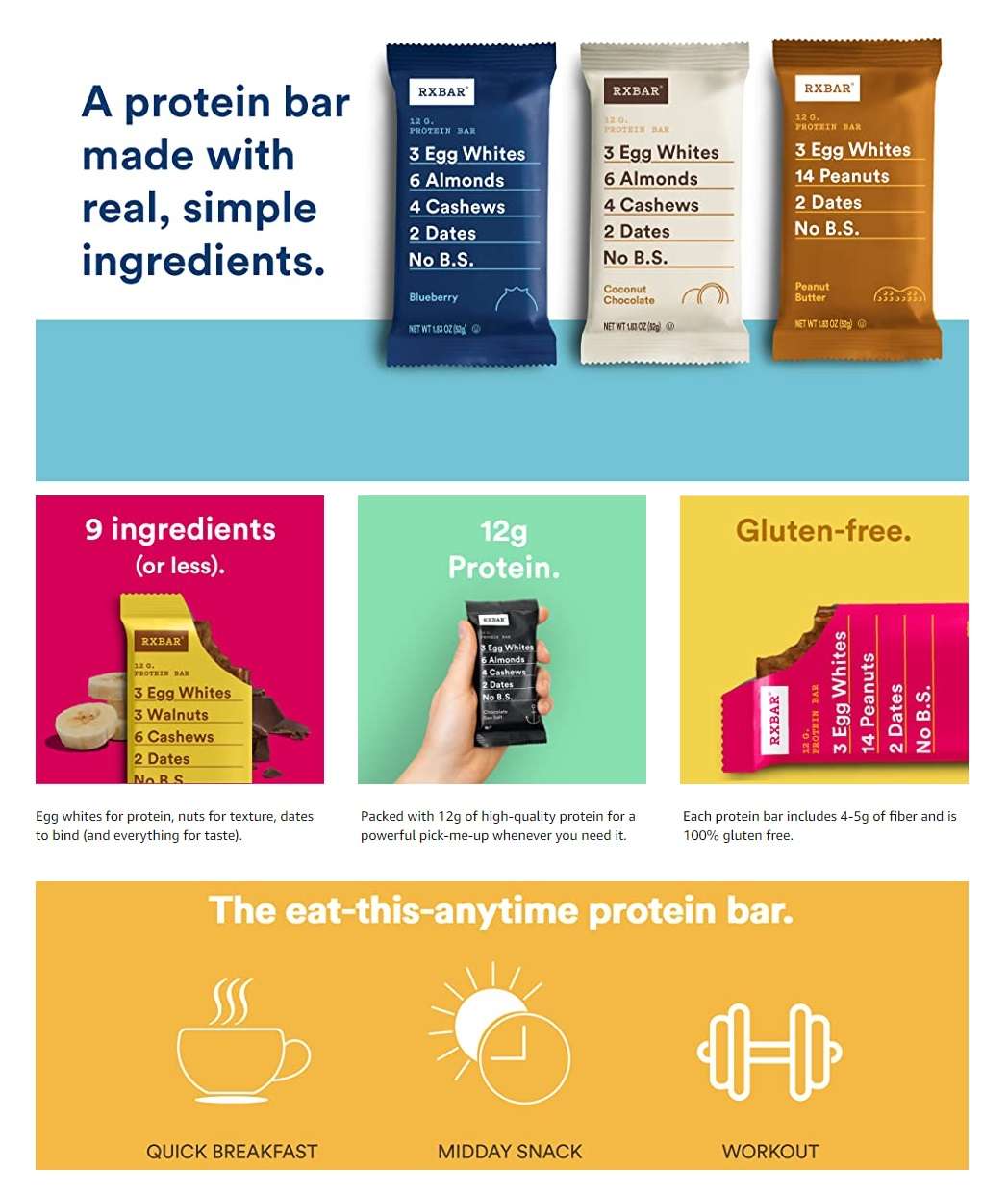

- Enhanced Brand Content (EBC) is simply presented, again reinforcing what makes this brand special in words and in pictures. Packaging, one of the brand’s key assets, is front and center along with bright photography that makes ingredients the hero. You really couldn’t design a more eCommerce friendly pack if you tried. RXBAR packages clearly identify the flavor and ingredients and are easy to read even on small mobile devices.

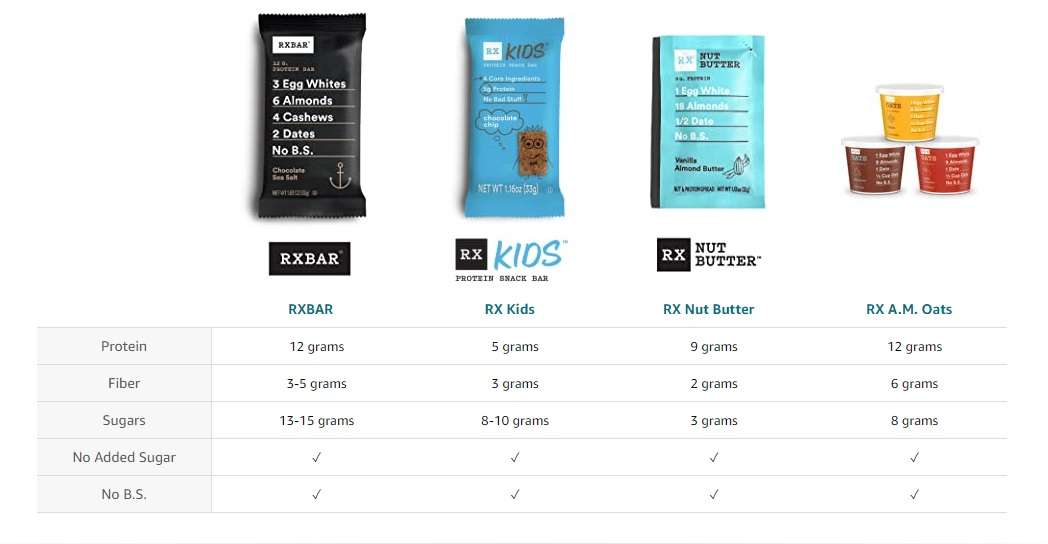

- The nutrition comparison chart in the brand’s EBC makes it easy to understand nutrition for each part of the RXBAR lineup. It also serves to encourage shoppers familiar with the popular bar to expand their horizons to RXBAR Kids or Nut Butter.

-

Amazon Sponsored Product and Sponsored Brand advertising are both used extensively to improve brand visibility (and to drive traffic to listing pages).

-

Item listings are structured with “parent-child” relationships, making it easy for shoppers to choose between different flavors and sizing options without having to navigate too much. This also allows reviews to aggregate and be shared between flavors/sizes.

-

The brand makes a point of answering customer reviews and questions. Doing this well can turn even negative feedback into a positive!

Missed Opportunities:

-

The biggest problem for the brand is the large number of low quality reseller listings on Amazon. In many cases, the factors that make RXBAR succeed on Amazon (good photography, playful copy) are missing from these listings which provide a poor shopper experience. Pro Tip: To avoid competing with your own resellers, be diligent about adding channel-specific selling restrictions into your reseller contracts from the get-go.

-

At 3.7 stars, the brand’s average rating is also a bit low. Again, this is likely dragged down by resellers who may not always have the freshest product or the best service.

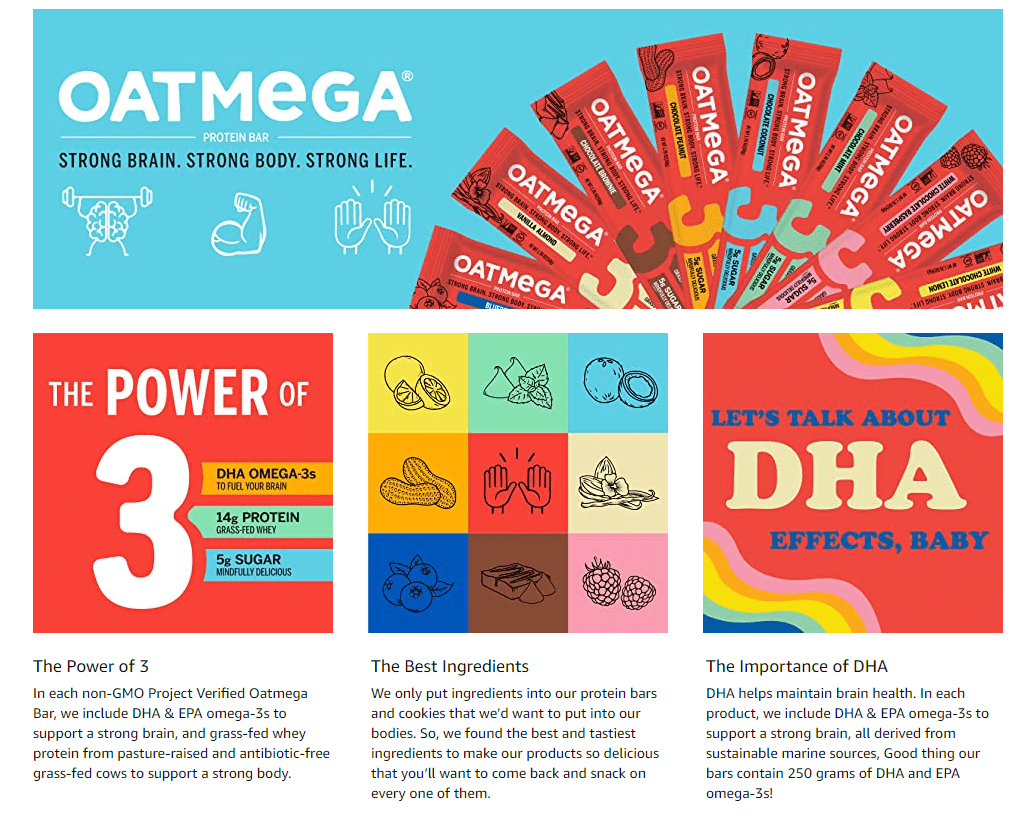

Oatmega

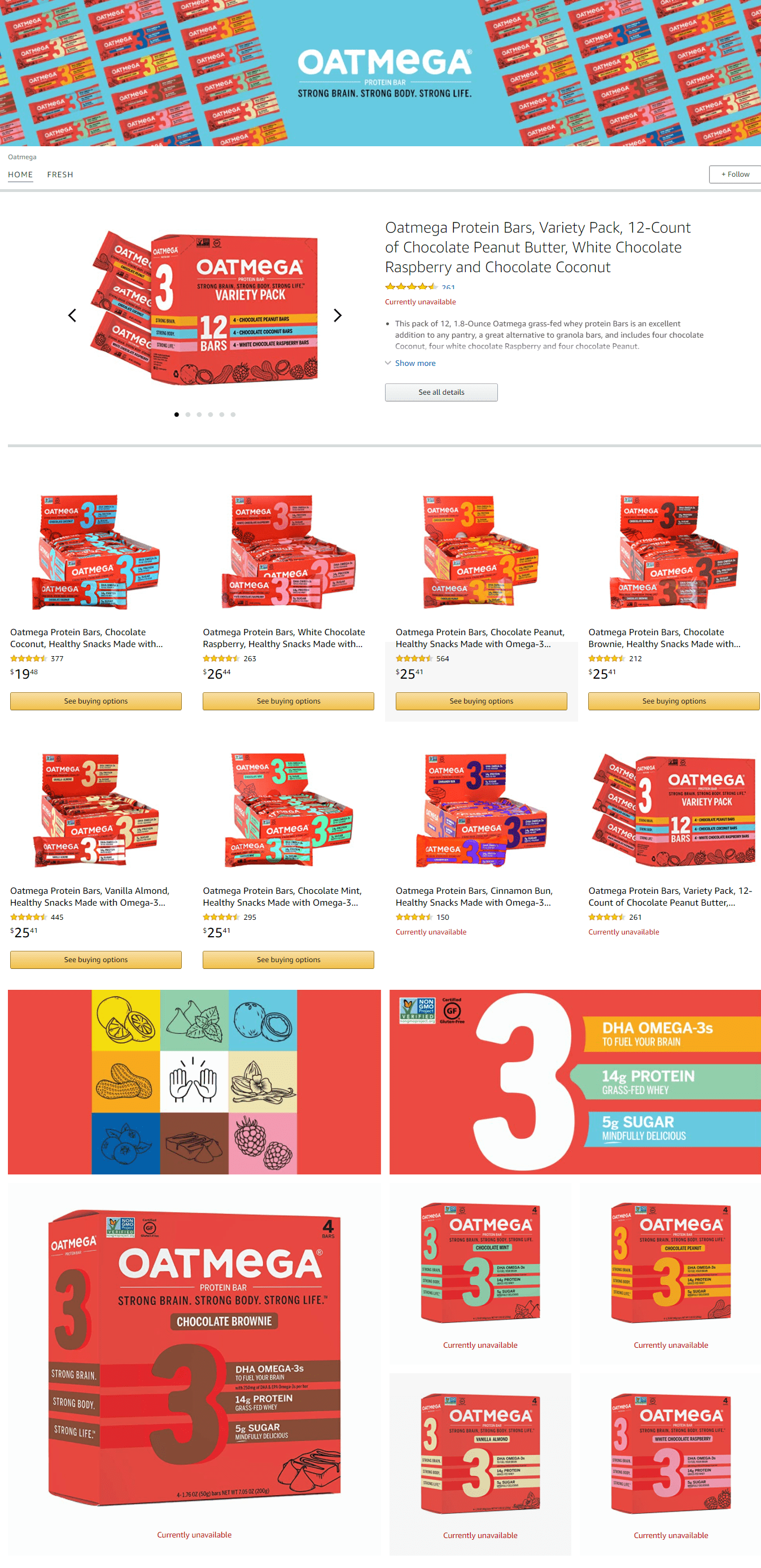

Although the name Oatmega is less known by most shoppers, it’s been around since 2007 and pulls in even more Amazon revenue than RXBAR (est. $35 million). Below, we’ve pinpointed what Oatmega is doing right—and where it could up its eCommerce game.

Success Drivers:

-

The product description on all listing pages is benefit-driven and keyword-rich, and the main points are bulleted for quick and easy comprehension. They also use caps to make the copy even more scannable (a common best practice).

-

The brand is very deliberate with SEO in its product information. They are trying (maybe a bit too hard) to win all the main category descriptors (protein bar, nutrition bar, energy bar, and snack bar). This makes the listing seem repetitive and less “human readable,” however.

-

Additional SEO terms are included in the title: OATMEGA Protein Bar, Chocolate Coconut, Energy Bars Made with Omega-3 and Grass-Fed Whey Portein, Healthy Snacks, Gluten Free Protein Bars, Whey Protein Bars, Nutrition Bars, 1.8 ounces (12 Count) - again, marginally good for SEO but bad for ease of reading.

-

Oatmega’s Enhanced Content is image-oriented, visually striking, and showcases the company’s many flavor options (along with other items such as their protein-rich cookies).

-

Amazon Sponsored Product and Sponsored Brand advertising are both used to improve brand visibility.

-

Parent-child relationships are also properly set up for this brand to enable easy shopping.

-

The company’s brand store looks good overall, reinforces brand image, and is simply laid out. That said, there are no shopping opportunities on the main page of the brand store - the shopper will have to work harder than necessary to convert.

Missed Opportunities:

-

Item titles are long and jam-packed with SEO keywords. While this strategy may have worked in the past, Amazon’s A9 search algorithm no longer disproportionately weighs title keywords. The emphasis is now on shorter, “human readable” titles that are clearly structured.

-

Customer feedback and questions have not been consistently answered. Customers are looking for more information about ingredients, among other things, and the brand is largely MIA.

The Takeaway

Protein Bars are a competitive category. Overall, both of these brands are doing an excellent job standing out from the pack and their results back this up — each of these teams should be proud of their work. If you’re looking to understand “what good looks like,” you could do a lot worse than RXBAR or Oatmega.

Stay Tuned

On the next Retail Recon, we’ll delve into Shampoo — a very interesting category given the wide range of price points, brands, and benefits available. In the meantime, if you’d like to learn more about best practices on Amazon, you’ll likely enjoy our latest eBook: “The Marketer’s Guide to Winning on Amazon.”