Retail Recon: Male Fertility Supplements on Amazon

October 24, 2022

Male Fertility supplements are a high-sales-volume niche product inside the Blended Vitamin & Mineral Supplements category on Amazon. While male fertility supplements don't have their own category, the top five performing listings rack up more than $300,000 in sales every month.

As part of our Retail Recon series, we’ll take a closer look at the sales trends around these supplements, how the winners are winning, and how the customer shops for fertility supplements. You'll also see examples of our favorite listings and discover what these products offer over the competition.

A Quick Overview of Male Fertility Supplements on Amazon

Amazon shoppers spend over $124 million on vitamin and mineral supplements every month. ‘Male Fertility’ doesn't have it's own category on Amazon so these products live inside the sub-category of Blended Vitamins and Minerals. Without a specific designation, topping this large, highly competitive category is unlikely. However, there are more than a dozen successful male fertility supplements on Amazon.

Successful listings for fertility supplements are capitalizing on ingredient-related searches and educational content. Building trust is critical for top listings. There are bad supplements out there, and shoppers know it.

A Look at 10 Top-Selling Male Fertility Supplement Listings

While there are some familiar grocery store names in the top spots on Amazon, the best-selling male fertility supplements also include several brands focused primarily on the online customer. This is a common trend in specialized products since the digital shelf has more room for shoppers to discover niche items for their specific needs.

Among the top 10 listings, there’s a steep drop off is share of sales after the top two brands. Retail powerhouse One-A-Day is leading the way in revenue with just two listings. Fairhaven comes in second in total revenue across the listings. Of the top ten brands, four have multiple Amazon listings.

Brand |

Share of Revenue |

| One A Day | 26% |

| Fairhaven Health | 21% |

| Theralogix | 15% |

| Male FX Labs | 14% |

| Pink Stork | 6% |

| Natures Craft | 5% |

| Best Nest Wellness | 4% |

| Windsor Botanicals | 4% |

| Sigma-Tau/Proxeed | 3% |

| Conceive Plus | 2% |

Shoppers Are Ready to Pay for Premium Products That Fit Their Needs

Unlike shoppers' approach to grocery shopping where low price is king, shoppers seeking male fertility supplements are choosing the higher price-per-serving option as often as they are choosing the value priced products. Products priced at $1-$1.50 per serving are grabbing just as much monthly revenue as the supplements priced under $0.40 per serving.

Supplement shoppers for this product don’t seem to be bulk buying. The vast majority of sales are going to 60-count listings or a one-to-two-month supply.

While there’s significant sales volume for male fertility supplements, the search trends are very specific. The most relevant terms, like “male fertility supplements” and “fertility supplements for men” have low search volume. A top search keyword is “Semenax” – a brand name that isn’t even sold on Amazon.

Despite the low search volumes around the term, all the top listings on Amazon use “Male Fertility Supplement” in their titles.

Male supplement shoppers seem to be informed shoppers. The highest search terms are around the effective ingredients rather than the product function or feature.

Keyword Phrase(Top 20) |

Monthly Search Volume |

| ashwagandha | 137,474 |

| pregnancy tests | 137,277 |

| zinc | 103,940 |

| vitamin e | 92,462 |

| prenatal vitamin | 89,185 |

| horny goat weed | 40,472 |

| maca root | 36,314 |

| testosterone | 34,543 |

| tongkat ali | 28,457 |

| yoni pearls | 27,508 |

| prenatal vitamin gummies | 27,508 |

| l carnitine | 26,715 |

| prenatal | 21,858 |

| l arginine | 21,814 |

| turkesterone | 21,781 |

| nordic naturals ultimate omega | 19,717 |

| testosterone booster | 15,470 |

| zma | 15,454 |

| creatina | 15,428 |

Because shoppers in this category are smart researchers, most of the top listings provide clear supportive proof and reasons to believe inside the product descriptions. These claims frequently boast clinical studies, lab tests and other ingredient validations. Very few listings have mentions of doctor recommendations.

Brand |

Claim |

| ONE A DAY | OBGYN Recommended |

| Semanoid | No claims |

| Theralogix | Lab tested and certified |

| Fairhaven Health | Clinical study |

| Natures Craft | Lab tested |

| Pink Stork | Lab tested, doctor recommended ingredients |

| Best Nest Wellness | Lab certified, created by a doctor |

| Windosor Botanicals | Third-party verified |

| Sigma-Tau | No claims |

| Concieve Plus | Doctor Recommended |

| Coast Science | No claims |

| Fertility Blend | Clinical trial |

| ACTIF | No claims |

| Proxeed | No claims |

How Brands Talk About Their Supplements

There are a few key components to what makes a winner on Amazon:

- Killer marketing to drive momentum and market share

- A strong digital shelf to attract, engage and convert shoppers

- Clear product differentiation to set brands apart from the competitors

- Smooth fundamentals like inventory availability and price to avoid hard sales stops

Let’s see how some of the top Male Fertility Supplements are doing on these, starting with…

🏆Top Male Fertility Supplement Seller🏆

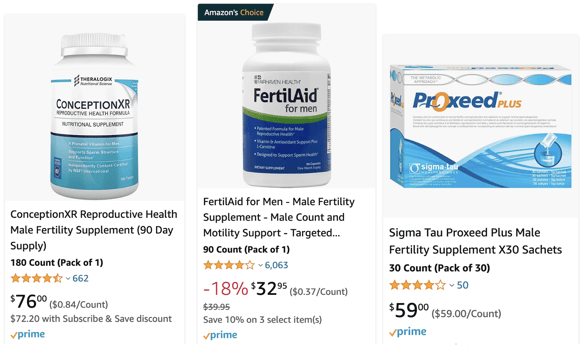

Image Source: Amazon.com

Fairhaven Health FertilAid has great-looking, highly-branded content on their listings, brand store, and A+ Content. The brand uses deliberate integration of key search engine-optimized (SEO) terms in the title and listing content.

Image source: Amazon.com

FertilAid uses a strong pay-per-click (PPC) presence in Sponsored Products and Sponsored Brands ads. FertilAid offers multiple pack count offerings on the listing as well as combo packs and supportive supplements and offerings for women.

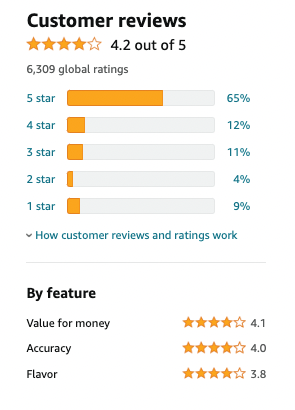

The listing has amassed more than 6,000 ratings and reviews with an overall rating of 4.2 stars, which is very close to the average 4.29-star rating of top selling male fertility supplements. The lowest reviews often mentioned disappointing efficacy and strong side effects.

Up next, let’s take a look at a listing that’s got some of the best visuals in the category, we’re calling it our…

😎Best Dressed😎

Image source: Amazon.com

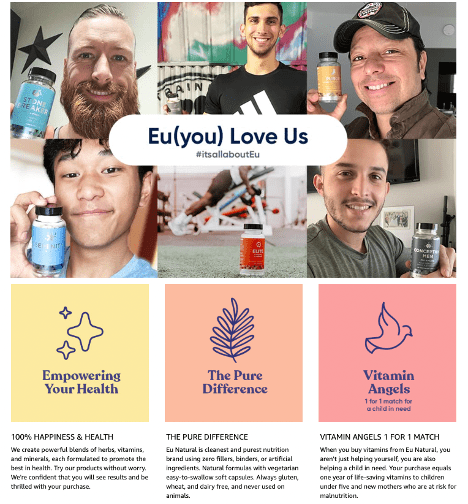

The EU Natural Contraception Men listing is utilizing the sameSEO-powered, benefit- and ingredient-language copy that the FertilAid listing does, but they’ve stepped up the game with their images. The product listing images are a collection of clean, well-designed infographics and the A+ content visuals have an influencer/user-generated aesthetic that can help tap into buyer confidence through social proof.

Image source: Amazon.com

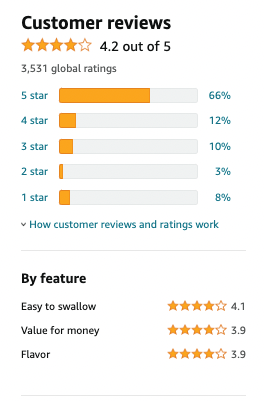

With over 3,500 ratings, EU Natural comes in at 4.2 stars, right around the product rating average. Highest marks were given to the brand by reviewers who said the product worked as promised. Lowest marks were for side effects. Multiple reviewers claimed the product triggered anxiety and depression.

And rounding out our 3 brand callouts, we’ve got our…

🏅Honorable Mention🏅

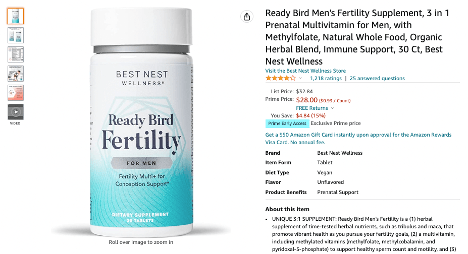

Image source: Amazon.com

While this Ready Bird Men's Fertility Supplement listing doesn’t have as many reviews or as much sales volume as the others, they are utilizing the Posts section of the brand store well. Their content is approachable, and they have a great founder story and quote in their content.

Image source: Amazon.com

Key Takeaways for Male Fertility Supplement Listings

- While there isn't a specific category for male fertility supplements on Amazon, there are several successful listings that combine strong content and SEO strategies to connect with buyers. Despite low monthly search volume for the most relevant terms, there’s a broad range of search and discoverability in this space.

- There’s also an opportunity to bring research-savvy shoppers to Amanzon from direct campaigns, including targeting pregnancy minded buyers using Amazon Demand Side Platform (DSP) or viewing related items like ovulation test strips, etc.

- Education around effective ingredients plays a role in winning the sale with these supplements. Various searches for ingredient-related topics in fertility queries likely shows intent for knowledge building.

- Building trust is a critical focus for male fertility supplement brands.

Ready to transform your strategy on Amazon?

Download BOLD's Services One Sheet.