Retail Recon: The Kids Snack Bar Category

August 29, 2022

There are thousands of snack bars to choose from on Amazon, but did you know that just the top few players in the category are capturing more than 80% of the sales?

As part of our Retail Recon series, we’ll look at the size of the category, how the winners are winning, and how the customer shops for snack bars. You'll also see some of our favorite examples of these product listings and what they have to offer over the competition.

The kids snack bar category at a glance

Amazon shoppers spend $60 million on snack and meal replacement bars every month…and parents are among those who are stocking up! Bulk packs like 10, 25, and even 36 counts grab the most revenue in the category. While protein bars account for most of those sales, snack bars like fruit and nut and granola bars are a growing sub-category.

Looking at the top ten best-selling offerings

Familiar grocery store brands sit at the top spots on Amazon in the category with the top 3 sellers dominating more than half the space in sales.

| Brand | Share of Revenue |

| Clif Z Bar | 32% |

| Quaker | 20% |

| Nature's Bakery | 10% |

| Orgain | 9% |

| Made Good | 8% |

| Larabar | 6% |

| RXBar | 4% |

| GoMacro | 3% |

| Skout Organic | 3% |

| KIND | 3% |

How brands talk about their bars

A look across the kids snack bar category reveals a similar strategy among the top-selling listings.

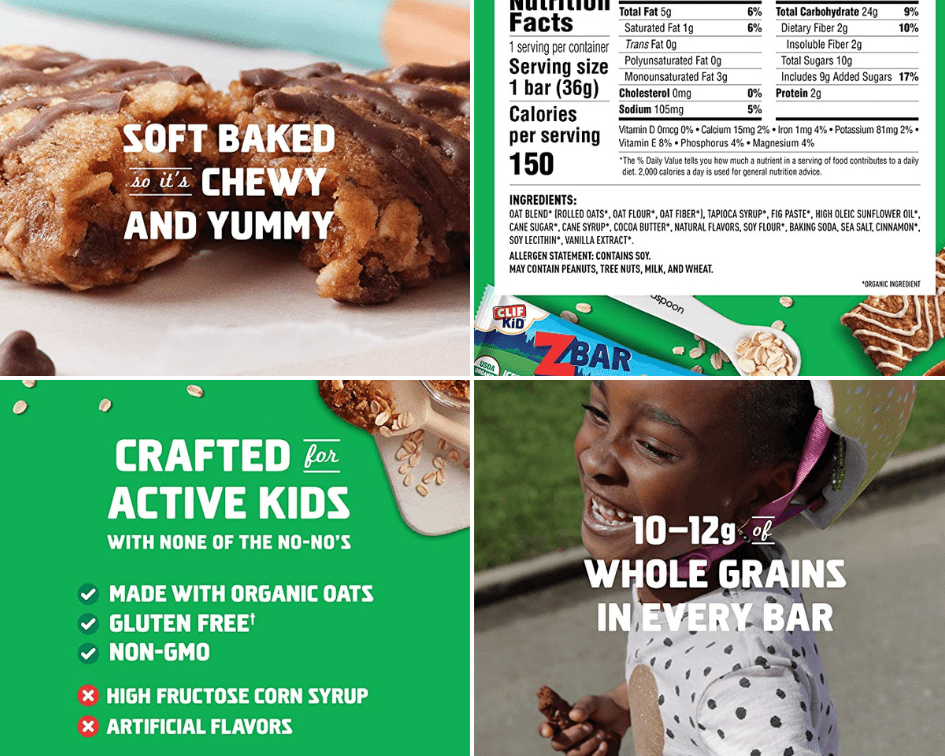

Copy and imagery in the category tells a “real” and “healthy” story. We see a strong emphasis on healthy vectors with phrases like ”free from”and “for your family” as well as ingredient buzz words like “whole grains,” “fiber”, “free from…” and “clean.” These listings also include certifications & badges like “Verified Non-GMO Project” or “Made In USA”.

Listing images play up convenience, ingredients, flavor and brand equity on the best sellers.

Image source: Amazon.com

Image source: Amazon.com

Shopper preferences: What parents want!

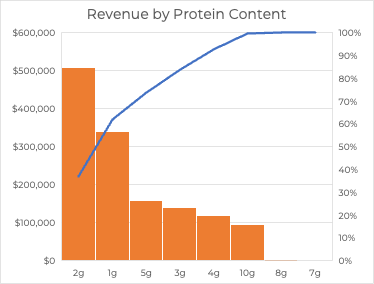

Unlike bars targeting adult eaters, shoppers in the category don’t seem to prioritize protein content. About half of the listings contain only 2g of protein. As protein content increases, revenue decreases.

We see the same sort of opposite correlation when it comes to fiber content and sales. Most of the revenue goes to bars with 1 or 2 grams of fiber.

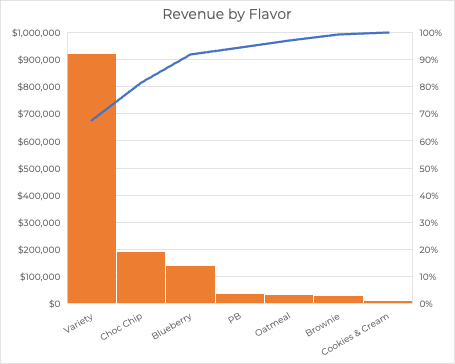

So if they don’t focus on fiber and protein, what do they want?

Chocolate chips, blueberries, and variety packs. Almost a quarter of the top listings have “chocolate chip” in the title – and while only one top listing mentions blueberries, that one listing earns the second highest monthly revenue in the category. Last and far from least, variety packs make up about half of the top 30 listings.

Not surprisingly, when shoppers are searching for kid’s snack bars, they are brand aware, with many of the top searches including a brand name. Clif Bar dominates kid-related searches across different spellings and variations.

| Selected Top Search Terms | Search Volume |

| kids snacks | 32,627 |

| kids protein bars | 4,392 |

| zbar protein kids | 2,586 |

| think kids protein bar | 2,286 |

| kids protein | 1,960 |

| power crunch kids | 1,875 |

| kids snacks healthy | 1,690 |

| kids granola bars | 1,454 |

| kids cliff protein bars | 1,452 |

| cliff kids | 1,434 |

| protein bars kids | 759 |

| protein bars for kids | 668 |

| power crunch kids protein bars | 611 |

| clif kids protein bars 610 | 610 |

A closer look at 2 top listings

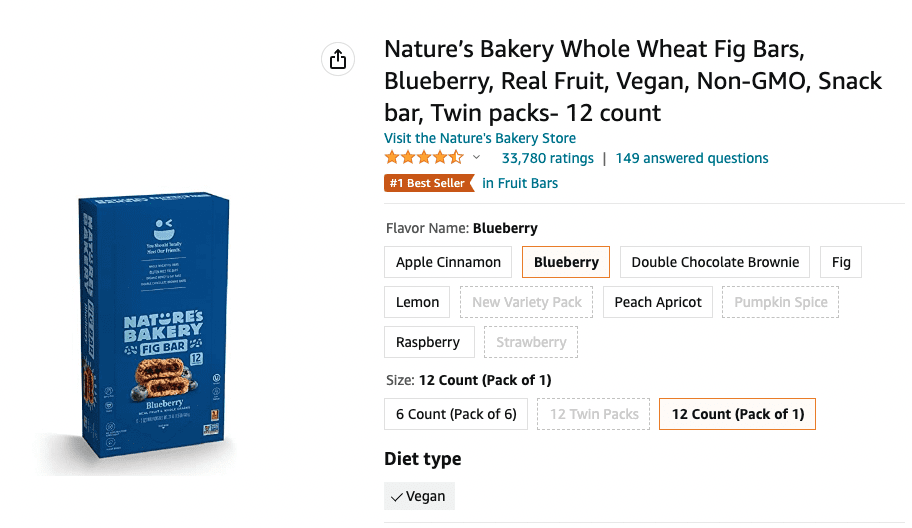

Nature’s Bakery

Image source: Amazon.com

Image source: Amazon.com

Summary of Claims & Benefits

- The copy around these products focuses on “thoughtful ingredients”: “real, sun-ripened blueberries, figs, wholesome whole wheat”.

- Nature’s Bakery also places strong emphasis on health factors such as the ”free from” ingredients and certifications of certain diets (Kosher, Vegan, etc.).

Top Keywords by Page 1 Ranking

- They’ve got a strong organic ranking across types of bars making them high ranking for many sub-categories.

- Good showing for ‘healthy kids snacks’.

| Phrase | Monthly Search Volume | Rank |

| Bakery | 26,332 | 1 |

| breakfast bars | 26,247 | 9 |

| vegan snacks | 26,245 | 6 |

| fig bars | 15,049 | 2 |

| natures bakery fig bars | 13,871 | 2 |

| natures bakery | 11,426 | 2 |

| breakfast & cereal bars | 11,409 | 19 |

| fruit bars | 8,999 | 8 |

| snack bars | 8,182 | 7 |

| kashi bars | 7,169 | 23 |

| made good granola bars | 7,163 | 24 |

| fig bars natures bakery | 5,455 | 1 |

| blueberry | 5,453 | 25 |

| healthy snack | 4,833 | 18 |

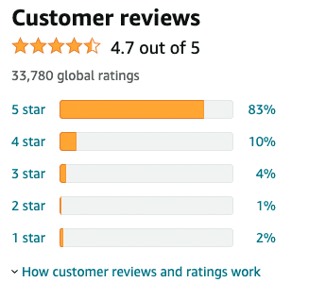

Reviews

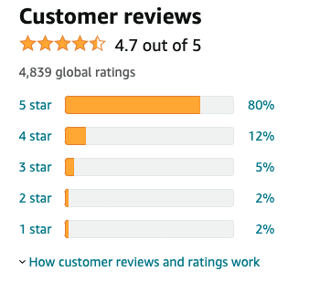

The reviews for the Nature’s Bakery top listing were overwhelmingly positive – with an average of 4.7 stars. Much of the negative feedback is related to the sugar content of the bars per serving. It also looks like product freshness has hurt this brand’s reputation.

Some of the lowest reviews have come from customers who received a stale product, which is often the result of too many resellers in the space selling unreliable products.

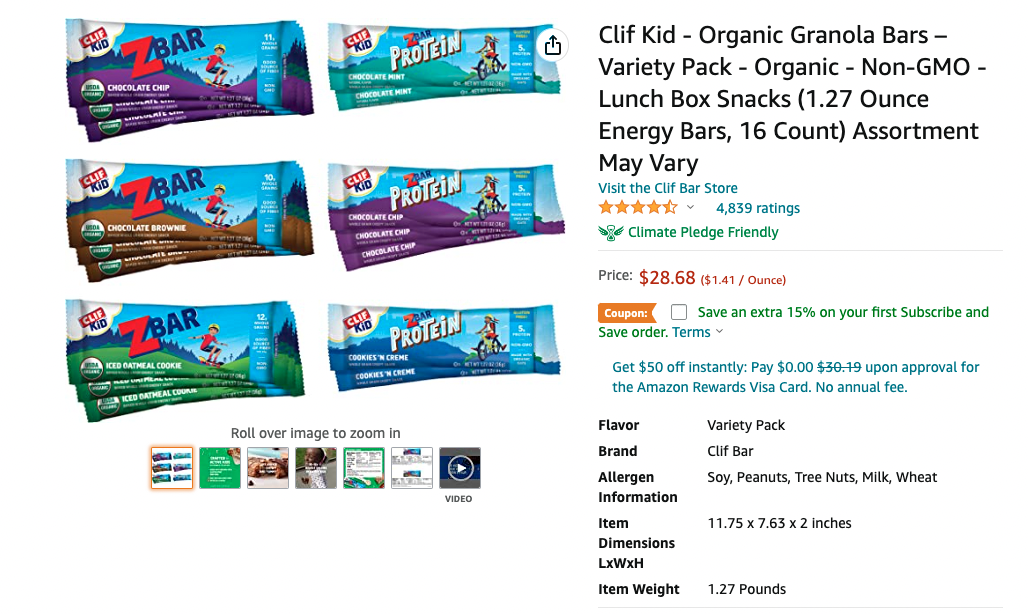

Clif Z Bar

Image source: Amazon.com

Summary of Claims & Benefits

- The copy focuses on the nutritional benefits, highlighting the bar’s 10-12g whole grains and source of fiber.

- The listings also include plenty of ingredient buzz words, like no artificial colors and gluten-free, and convenience for kids language.

Top Keywords by Page 1 Listing

- A strong showing for keywords on page 1 with4 kid non-branded keywords and 3 branded keywords.

- Clif Bar is ranking for blueberry despite having no offering for that flavor.

| Phrase | Monthly Search Volume | Rank |

| z bars for kids | 6,356 | 1 |

| kid snacks | 5,207 | 12 |

| kids protein bars | 4,585 | 4 |

| clif bar | 3,846 | 24 |

| cliff bar | 3,846 | 23 |

| balanced breaks | 3,432 | 15 |

| z bar | 3,316 | 1 |

| elfbar | 2,707 | 17 |

| kids snacks individually wrapped | 2,703 | 16 |

| zbar | 2,701 | 1 |

| energy bar | 2,579 | 12 |

| z bars | 2,534 | 3 |

| mosh bars | 2,047 | 25 |

| dino bars | 2,043 | 22 |

| zbar protein kids | 1,793 | 2 |

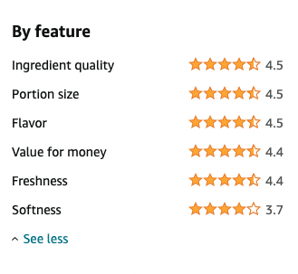

Reviews

The reviews for the Clif Bar top listing were extremely positive – with an average of 4.7 stars and the highest marks for freshness. The small amount of negative feedback often mentioned the low protein content.

Some of the lowest reviews have come from customers who were looking for better quality ingredients, especially considering these are a higher price point than other category offerings.

Takeaways from looking through the Kids Snack Bars category

A look at the top sellers in this category reveals lots of common factors between top competitors.

- Benefit and nutritional language was a key point for all top sellers and the imagery most often highlighted kid friendly taste, whole ingredients, and convenience.

- It’s a competitive category where brand loyalty is high and but there’s certainly room in this category for products that deliver on parent confidence and kid preference.